Curtis has earned the Life and Health Insurance licensure, has passed the Series 66 examination, and has earned a degree from the University of Nevada, Reno. He has over 16 years of experience in the financial industry, helping others protect, grow and manage their wealth. Curtis helps clients create customized strategies for their portfolio based on their unique financial goals.

Scott has been in the financial services industry for over 15 years and is a co-founder of Cornerstone Wealth Partners, LLC. Scott has been a Registered Representative since 2005 and believes that being independent is crucial to providing unbiased counsel to his clients. Growing up in Kernersville, NC, Scott was an Eagle Scout prior to. He helps people to better manage their wealth so they can focus more of their time on what truly brings meaning and fulfillment to their life. Abts is also the TV show host of Redefining Retirement, which airs every Sunday evening at 5:30pm on KTVN Channel 2. Retirement Cornerstone ® is a registered service mark of Equitable Financial Life Insurance Company, New York, NY 10104. Retirement Cornerstone ® variable annuities are issued by Equitable Financial Life Insurance Company, New York, NY 10104. All contract and rider guarantees, including optional benefits and any fixed subaccount crediting.

When Life Changes Your Plan, How Do You Adapt?

Last weekend my family and I decided to take a long weekend up to Lake Tahoe. Lake Tahoe is one of those places that we always seem to take for granted. It is a beautiful spot, one that many people travel from all around the world to see and with it being in our backyard, you would think people like myself would make more of a conscious decision to get up there and get away more often. Being someone who likes to plan things, I had a whole itinerary for my family to follow for our three days up there.

Well, like all good plans, nothing came together as I expected. There was a cycling event that ranged all the way from Tahoma to Emerald Bay and was scheduled for the entire weekend. So, my plan had to be adapted as we had goals in mind of what we wanted to accomplish during our getaway. With that one minor event we now needed to make some changes to our plan and doing this with an 18-month old can be pure chaos. However, with some communication back and forth and some different ideas between my wife and I, we were able to reach our destination without any added headache.

The reason I bring this up is that your financial plan should be no different. Life will happen, things will happen, changes will happen. One thing will go according to plan and another will just fall off the rails. To this I would say, that is what we, as financial advisors, are here for. We know that having that foundation of a plan is important, we also realize things will change and that at times in our relationship with our clients we will have to adapt.

It is important, almost paramount, that the lines of communication remain open. People get busy with work, life, you name it. It is important that communication remains clear, so as things change, the proper discussions can happen to adjust to those life events, changes in thoughts, or even possibly looking at alternative paths. Having ongoing reviews, open lines of communication and face to face meetings allow both parties to make sure when change happens, we can make sure to adjust properly to accomplish our goals.

For example, I had some clients come in last week who had some questions regarding increasing some of their spending for the next five years, as they planned to travel to their dream destinations of Europe and Thailand. So, for our review we sat down and looked at different levels of spending and what could go right and what could possibly go wrong. We had a good open discussion about spending, risk, risk reward and inflation.

The reason I bring this up is that your financial plan should be no different. Life will happen, things will happen, changes will happen. One thing will go according to plan and another will just fall off the rails. To this I would say, that is what we, as financial advisors, are here for. We know that having that foundation of a plan is important, we also realize things will change and that at times in our relationship with our clients we will have to adapt.

It is important, almost paramount, that the lines of communication remain open. People get busy with work, life, you name it. It is important that communication remains clear, so as things change, the proper discussions can happen to adjust to those life events, changes in thoughts, or even possibly looking at alternative paths. Having ongoing reviews, open lines of communication and face to face meetings allow both parties to make sure when change happens, we can make sure to adjust properly to accomplish our goals.

For example, I had some clients come in last week who had some questions regarding increasing some of their spending for the next five years, as they planned to travel to their dream destinations of Europe and Thailand. So, for our review we sat down and looked at different levels of spending and what could go right and what could possibly go wrong. We had a good open discussion about spending, risk, risk reward and inflation.

Cornerstone 401k Changed Their Name

What we were able to determine during our time together is that they would be able to increase their spending, barring we did not have them situated in a portfolio with too much risk. It was important for them to see that if we had too much risk exposure and were to experience a significant correction in lieu with their increased spending we would potentially put their financial security at risk. It allowed us to have some real in-depth conversation about gains vs. losses, risk and reward and how we could adjust their plan to achieve their goals. Sitting down together to weigh the pros and cons of such a decision allowed them to have peace of mind as we made some changes to their financial plan.

Remember, as a financial advisor we expect things to change across a myriad of different paths. At Cornerstone, it is also our job to make sure we stay on course to help you achieve your goals. Whether it is a cycling event on a two-lane mountain road, a family trip to the Hawaiian islands or a change in your risk comfort level we are here to work with you to make sure we can adapt your plan to help you to achieve your goals.

Cornerstone 401k Changed Their Name To Be

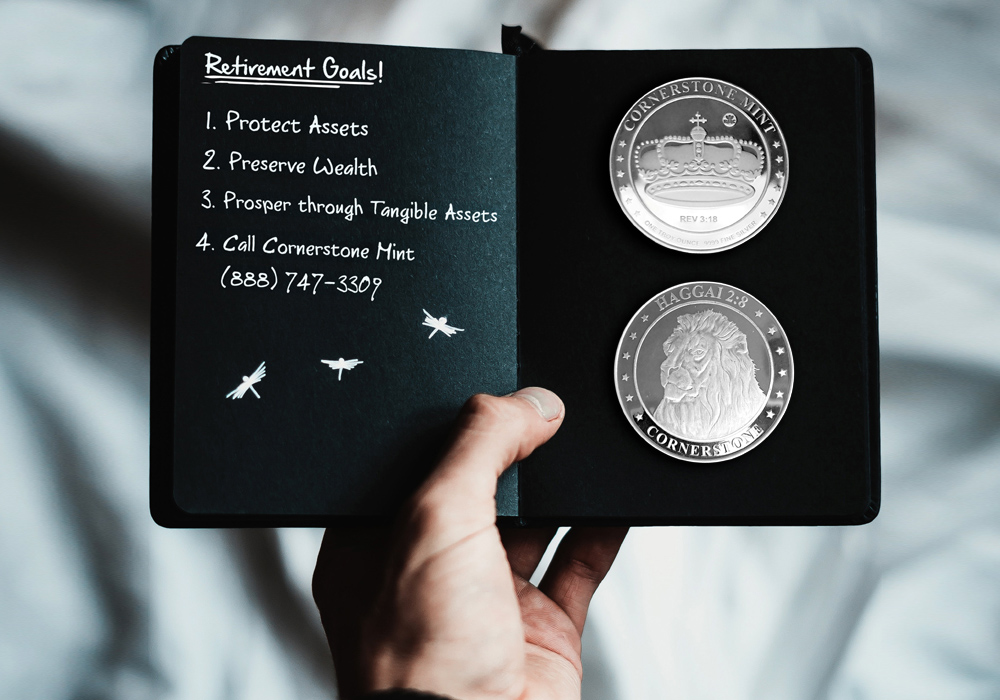

Based in Reno, NV, Cornerstone is for individuals and families looking to grow wealth, protect and preserve their life savings, and plan for the distribution of their estate in a tax-efficient manner through a tailored strategy. Schedule a time to discuss your financial goals with us.

Situation: Employee engagement and retirement readiness are trending topics in the retirement plan marketplace. Cornerstone understands employers' need for support in these areas. Our team of participant services professionals meets with participants to explain options within the plan and to promote disciplined retirement savings strategies. In some cases, when an employer makes significant plan changes, our team helps explain concepts that are foreign to most people.

One recent situation involved an industrial organization that was terminating their defined benefit plan in favor of a defined contribution plan. This change allowed employees to make one of several choices: cash out, roll into a 401(k) plan, or accept payment in the form of an annuity. The employer had several locations, had both union and non-union employees, and was undertaking this project during a period of market volatility.

Solution: Because each employee's decision needed to be based on individual factors, Cornerstone's participant services team set up several town hall meetings to explain the purpose of the change and the choices available. Knowing that these group meetings would be insufficient for most to make educated decisions, Cornerstone also met one-on-one with employees to discuss their situations and help them understand the information provided by the company.

Because Cornerstone also manages the company's 401(k) plan, we were able to create a single point of contact for employees to learn about their options. Although the participant services team could not provide individualized advice to the participants, our onsite consultants were able to provide plain language interpretations for employees.

Results: We have often seen that when employees have the option to 'cash out' their retirement plans instead of rolling them into other retirement vehicles, more participants will choose to take the cash than is likely in their long-term best interest. However, in this case, most employees chose to roll the money from their defined benefit plan into the 401(k) plan or elected to take an annuity payment upon retirement.

The importance of these decisions is magnified when considered relative to the state of retirement readiness in America. Many workers struggle to maintain a disciplined retirement savings strategy and to resist the urge to tap into their retirement savings too early. By extending their rapport with participants in the 401(k) plan, Cornerstone's participant services team was able to help them make strong decisions for the defined benefit plan termination.